Life

generosity, Hong Kong, money, on the road, rich, wealth

When you’re a kid, you don’t have much concept of what true wealth is—so you tend to relate it to experiences, or at least I did. In my case, I understood wealth in the context of fast-food restaurants. I used to eat at my favorite restaurants, McDonald’s and Burger King, as often as I could.

I’m writing from the W Hong Kong, where I just arrived after beginning my latest Round-the-World trip. The W here has one of the best hotel breakfast buffets in all of Asia, which for all practical purposes means all of the world.

My breakfast is comped, thanks to my elite status with Starwood. As best I can tell, it costs approximately 10x what a meal at McDonald’s would. But if it wasn’t comped, I’d gladly pay. It’s so good! And I’m having so much fun waking up early, drinking unlimited macchiatos, and thinking about the world.

The lesson? Well, I’m jet-lagged, so you might have to wade through the muddle. But aside from not eating fast food, I think the lesson is to figure out what makes you feel rich—and it’s best if such a thing is somewhat obtainable.

Read More

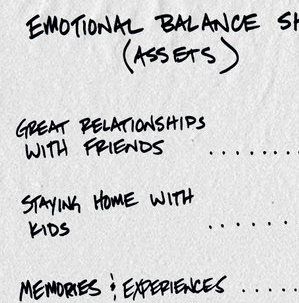

Deciding how you value your time can help you make decisions. But how do you really know what your time is worth?

Deciding how you value your time can help you make decisions. But how do you really know what your time is worth?

I often enjoy the personal finance columns by

I often enjoy the personal finance columns by

Through the camera, Powell is starting a conversation about debt—something many people experience alone but never talk about because of the shame and stigma that can be attached to it. How does debt effect us and our daily lives? Are people as alone in this struggle as much as they feel?

Through the camera, Powell is starting a conversation about debt—something many people experience alone but never talk about because of the shame and stigma that can be attached to it. How does debt effect us and our daily lives? Are people as alone in this struggle as much as they feel?