How Much Money Do You Really Need?

As I worked on my Annual Review recently, I finalized a choice I had been pondering for a while. The choice was whether I should continue scrambling to earn a good living as an entrepreneur while writing on the side, or to go “all in” with the project I believed in more – writing full-time. As I thought about it, I realized that while this choice was new to me, it’s fairly typical for anyone who chooses an unconventional career. It’s easy to say you should do what you love, but you have to be able to make some kind of living while doing it. There is no guarantee of success, and many people give up and return to a compromise career.

One of the things that makes the difference between success and failure is basic financial planning.

You may not be able to chart your path to millionaire status right away, but if you can find a way to pay the rent while you’re doing what you love, you’ll be off to a good start. This will free up the pressure to change careers, and may even enable you to leave a job that is unfulfilling.

Three Ways to Plan

There are at least three ways to look at the question, “How Much Money Do You Really Need?” The first is traditional budgeting, or the bottom-up model; the second is capital accumulation; the last is the alternative income plan.

We’ll look at each of these briefly, and if you want to learn more about any one of them, you can find additional resources at the end.

1. Traditional Budgeting

Budgeting itself is fairly simple. Most people can create a budget in less than an hour, using a computer or just a piece of paper. Mint.com, the free software I use to track my finances, has a tool that will help you do this – as does Microsoft Money and Quicken.

If you want to reduce your spending, it’s better to use the bottom-up approach where you base the initial budget on expenses instead of income. This is because we tend to increase our spending as we increase our income. I read in The Atlantic last month that 40% of Americans with incomes of more than $100,000 said they were living “paycheck-to-paycheck.” Naturally, some of us might read that and think, how irresponsible.

But actually, it’s possible to earn $100,000 or any amount of money and struggle more with debt and runaway spending than someone with much less. Whether we make $20,000 or $50,000 or $100,000, we can either find a way to meet our needs at each income level or we can easily lose track of the money.

As I considered the decision to “go pro,” I went through the budgeting process all over again to make sure that a) I would be able to meet our most basic financial needs, and b) I would be able to do at least some of the things we enjoy.

I don’t want to stop traveling the world, and I do want to help Jolie become a professional artist. If we had to give up either of those priorities, then I probably would have found a way to do something different. The major challenge with budgeting is following the budget you’ve set, so it’s important to set a realistic budget based on your own situation and values from the beginning.

2. Capital Accumulation

Since the promises of pensions and social security payments are increasingly unreliable, most traditional retirement planning focuses on the goal of accumulating enough money to live off the interest and dividends. I also focused on this for a few years, and began saving diligently for what I hoped to be financial independence. This was before:

a) I realized I like working and never want to formally “retire”

b) I changed my work to focus more on writing and less on earning money

c) The stock market stopped making free money for all of us and started taking it away

All three of these events led me to reconsider whether I really wanted to spend a number of years with making money as my primary focus. The more I considered it, the more I realized I wanted to spend the most productive years of my life doing things I enjoy.

One of the early ideas for this site that it would track my goal of creating financial independence while I traveled to every country and went to school full-time. Well, plans can change. I’m no longer in school, and I’m no longer on track for financial independence anytime soon. But that’s OK, because what we’re building over here is better than that.

In addition to the reasons listed above, I also realized that it was going to take me a really long time to acquire a large amount of capital. Granted, I was on the right track – most wealth is created by entrepreneurs, not through working for someone else – but as best as I could forecast it, it would probably take me at least 5-7 years and perhaps longer to achieve the wealth I had hoped for. I still have capital accumulation as a long-term goal, but it’s faded into the background as I now use a version of the alternative income plan below.

3. The Alternative Income Plan

The alternative approach focuses on income much more than wealth. Since most of us are not on track to become the next Rockefeller or Kennedy, it can be more realistic (and also more motivating) to focus on creating the income we need for the lifestyle we desire.

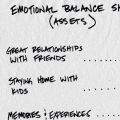

After building a budget to cover basic needs and designating funds for charitable giving, I begin looking at specific expenses that are technically optional, but still important to me.

For example:

- I want to buy a new Round-the-World ticket, and I’ve set it as a major travel goal for next year. The ticket will reduce my overall flight costs to less than $400 per trip, but the initial investment is about $5,000. Therefore, I have a new project to work on: “Get $5k for the RTW ticket.”

- I really enjoyed our end-of-year vacation a couple of weeks ago, and I definitely want to repeat that at the end of 2009. It will cost approximately $3,000 to do that, so I’ve set that as another mini-project: “Get $3k to fund 2009 vacation.”

This kind of planning always comes back to values – what do you really want? What is most important? I value life experiences more than “stuff,” so after meeting basic needs (including a charity fund), I spend most of my disposable income on world adventures. You may not have the same priorities, but I guarantee it will help to spend some time thinking about how much money you need to do the things you want.

Wrap-Up

As I finished up the Annual Review, I settled on a personal theme: 2009 is the Year of Convergence. I’m going all-in on what I really want to do, and I’m going to do this full-time next year.

In terms of my finances, the next step is to look at what that means in detail. I’ve created a revised budget, put the financial independence (capital accumulation) plans on hold, and started working on finding a way to pay for the next Round-the-World ticket.

In the upcoming sequel to the World Domination manifesto, I’ll include detailed estimates of how I plan to earn my living through this project. It doesn’t help to be vague, so I’ll be very specific and provide real numbers.

Since many readers here are also working in unconventional careers, I’m curious to know what you think about financial planning during the imploding economy.

What’s missing here that you would like to add?

***

Additional Resources:

Mint.com (online personal finance tracker)

Your Money or Your Life (book)

The Number (book)

Get Rich Slowly Forums

Early-Retirement Forums

###

Image: Austin Kleon

17 Comments

Multiple income streams is my way forward, combined with multiple skill sets. I have already changed careers 3 times and plan a few more yet.

You must also be prepared to do anything. In the last few years I have cleaned chicken ovens at Tescos, done paper rounds, all while doing a degree and Ph.D. in my 30’s.

Just found your site the other day Chris, and can’t get enough of it. Keep up the good work and we will keep reading!

Chris, as always, I appreciate your candid comments. I would love to hear your thoughts, especially in regards to budgeting on health care / health insurance.

Thanks for the timely posts (this one and the earlier five year planning).

I’ll turn 50 this year. When I started out, my career seemed to have a natural linear path comprised of a well defined progression of jobs and promotions. I did very well with this model for more than 20 years, but the last eight or so years have been a struggle in finding the path.

I’ve recently come to realize that the path of my youth doesn’t exist any longer. My career is no longer linear and the best moves are not necessarily upward in terms of prestige or money. The best move is the one that keeps me financially satisfied and intellectually challenged.

Your posts and the other reader’s comments offer great insight as I shift paradigms. Thanks for the help.

peace and happy new year to all!

Rick

Chris, great article…I was just thinking some similar thoughts yesterday. I recently opened up a new part of my business and it took off very quickly. When I actually calculated how much extra money I will have it hit me: “what am I going to do with this?”

A lot of us (myself included) tend to focus on money without really understanding what we want it for. Doing this sort of planning is essential for that part. Great job.

Chris, thanks again for your grounded commentary here as I too, am in the process of assessing my 2008 and planning for the new year. I recall that one of your earlier posts had detailed line items that you felt were “optional;”- one of them being health insurance. How do you proceed from a practical standpoint with this stance? I am curious about your thoughts as it is a cost that continues to increase with some regularity…I really appreciate how you challenge yourself and your readers!

interesting post

what I’ve chosen to do is to focus more on building wealth and income streams that will fund my lifestyle without me needing to work

i.e. rather than spending $5,000 a year on travel, I’d prefer to instead save and invest $50,000 @ 10% returns (or $100,000 @ 5% returns) to then earn $5,000 interest each year, every year for the rest of my life

living of interest is a beautiful thing! 🙂

Chris, I want to thank you for including a subtle, yet important message in this post. A couple times, you mentioned that your budget includes charitable giving. It’s so easy to forget that we get back what we give… and the accumulation of wealth includes giving. The question isn’t just, “How much I can earn in this world?”It’s, “How can I use what I earn to make my life and others’ lives even better?””

Chris,

You continue to provide inspiration with your posts! With 5 mouths to feed and a very security conscious wife, I’ve opted for multiple streams of income at the expense currently of what I truly want most. I believe that especially in today’ economy it’s important (and possible) to create income in a variety of ways (online, offline, traditional, and non-traditional) in order to achieve my goals and achieve the “security” my wife needs in order for me to walk away from full-time employment.

Being that it’s just the two of you and you have no kids, go for it all now as it gets lots more complicated once you have kids to feed. I wish I knew 20 years ago what I know now as it would have been lots easier for me to walk away from the corporate grind!

Our offline, traditional business is growing like gangbusters! 2009 is my year and I believe it will be yours as well!

Dear Chris,

I recently subscribed and have been reading your posts for a little while.

Thank you for sharing your thoughts. I appreciate the ideas that are outside the norms I would generally consider. In this post it is the Alternate Income Plan.

A great opportunity to re assess what I am doing.

Very nice article. Interestingly, I too was thinking about similar stuff just a few days back. Don’t know if the year end has anything to do with it 🙂

I agree, an income is not an end in itself. It is the means for us to have a certain lifestyle. I too, like you value experiences over purchasing ‘stuff’. Uur experiences and learnings that always stay with us, unlike the material ‘stuff’ that we accumulate.

It was nice to read your thoughts on this subject. You gave me some interesting ideas, and also validated my own thoughts to some extent.

—

Thanks

Parag

Chris,

I’m definitely on an Alternative Income Plan, and it’s working quite well. It was really interesting to see these approached outlined, especially since you included #3…the one not typically included in financial planning advice.

As always, I relate well to your philosophy on living. Thanks for letting us in on your thought processes 🙂

Chris, you’ve nailed it! This is precisely the credo that I embarked on mid 08. Being self-employed, I’ve had to transition my way out of what I’ve been doing for the past 20 years. It takes time to do this, but what I’m doing is taking my business and principles from offline to online. Why? To reinvigorate my work life, to connect with a global audience, to follow my passion for writing about the need for humanity to change in every conceivable way (vis-a-vis climate change impacts, environment, human habitats, self-sufficiency), and to create sustainable income that will allow me to live the way I choose and to transfer funds to global causes. A dream? Not really – it’s my goal.

But to achieve this there has to be a PLAN – obvious stuff, but quite simply a vital step that many people don’t observe. What you have described is a sensible step in this direction.

What works for me is to break down essential expenses into categories, and then work on projects that will meet those individual expenses.

All the best for 2009 …

Des M

“The more I considered it, the more I realized I wanted to spend the most productive years of my life doing things I enjoy. ”

After spending the holidays with family in a retirement community in Florida, this sentiment strikes home more than ever. This is not to say that saving for the future isn’t important and health issues can’t change situations instantaneously. But, more than ever I realize that the notion of putting off the things you want to do in life until retirement does not match our life goals.

I also really like the perspective of budgeting using your necessary expenses for a lifestyle you want vs. how much income you’re bringing in. This visit to the States also made us we realize why our friends think we must have won the lottery to travel as long as we have. You can hardly find a crummy highway hotel here for less than $30, while in many of the areas we’ve been in Asia we slept, ate and lived well for $30/day between the two of us.

When we do settle down after this RTW journey, we may end up in South America or Asia for a while. The lower cost of living combined with the weather and cultural stimuli seems like the right combination to help us continue our goal in creating a successful location independent and entrepreneurial lifestyle. We’ll see…

Great stuff Chris, but what I ultimately want to do is not worry about a constant income, and let hard work or laziness not be a huge dilemma. I have a webcomic and hope to make it grow. It probably won’t grow out of proportion, but I’ve got to be persistant. I just had a random thought: do what you love and the money will follow, but if what you live does not make money (lets take paleontology or Marine biology for example) set up multiple streams of income to not worry about money. I really could care less about having multiple cars or a huge house or toys (Metal Gear Solid 4 is the only costly thing I want). Might be naive, but just a thought

Hi Chris, I would say that how much money we need is based on how much money we wish to spend! Our grand parents didn’t have much but they managed… But back then, they didn’t have publicity and marketing telling them that they NEEDED this or that. We live in a ‘I need this now’ society where nowadays no one is willing to wait until they have the proper amount to indulge into purchases… I am not saying that we have to go back to the old cabin in the woods thing but before making any kind of purchase, we should think about it overnight and then decide if we can live (or not) without such and such thing… 🙂

I often ask myself the same question. Although I pose it slightly differently: “What’s the minimum I need to win at the lotto for me to stop working?” Well, I know the odds aren’t with me, but a man can dream no? I’m a big believer in the wisdom of crowds so it helps to see what others like you say (or don’t say). I came across this tool which I thought was pretty insightful.

http://www.ingcompareme.com

May help you determine how much is enough!

Your comments are welcome! Please be nice and use your real name.

If you have a website, include it in the website field (not in the text of the comment).

Want to see your photo in the comments? Visit Gravatar.com to get one.